The Cedars community news & events

Start the New Year with Comfort, Safety & Community at The Cedars of Austin

Start the new year with confidence and peace of mind. The Cedars of Austin provides a supportive, family-owned senior living community focused on comfort, connection, and dependable care for residents and their families.

The Everyday Grace of Gratitude

At The Cedars of Austin, gratitude runs through every day—from the familiar hellos to the trust shared between residents, families, and staff. See how that spirit makes life here feel like home.

Honoring Our Veterans Year-Round at The Cedars of Austin

Honoring those who served is an important part of life at The Cedars of Austin. From monthly lunches to our Wall of Honor, we’re thankful for every opportunity to show appreciation to our veteran residents.

How Our Community Creates a Home-Like Environment for Residents

Discover how The Cedars of Austin brings warmth, familiarity, and genuine connection to senior living—creating a community that feels like home from day one.

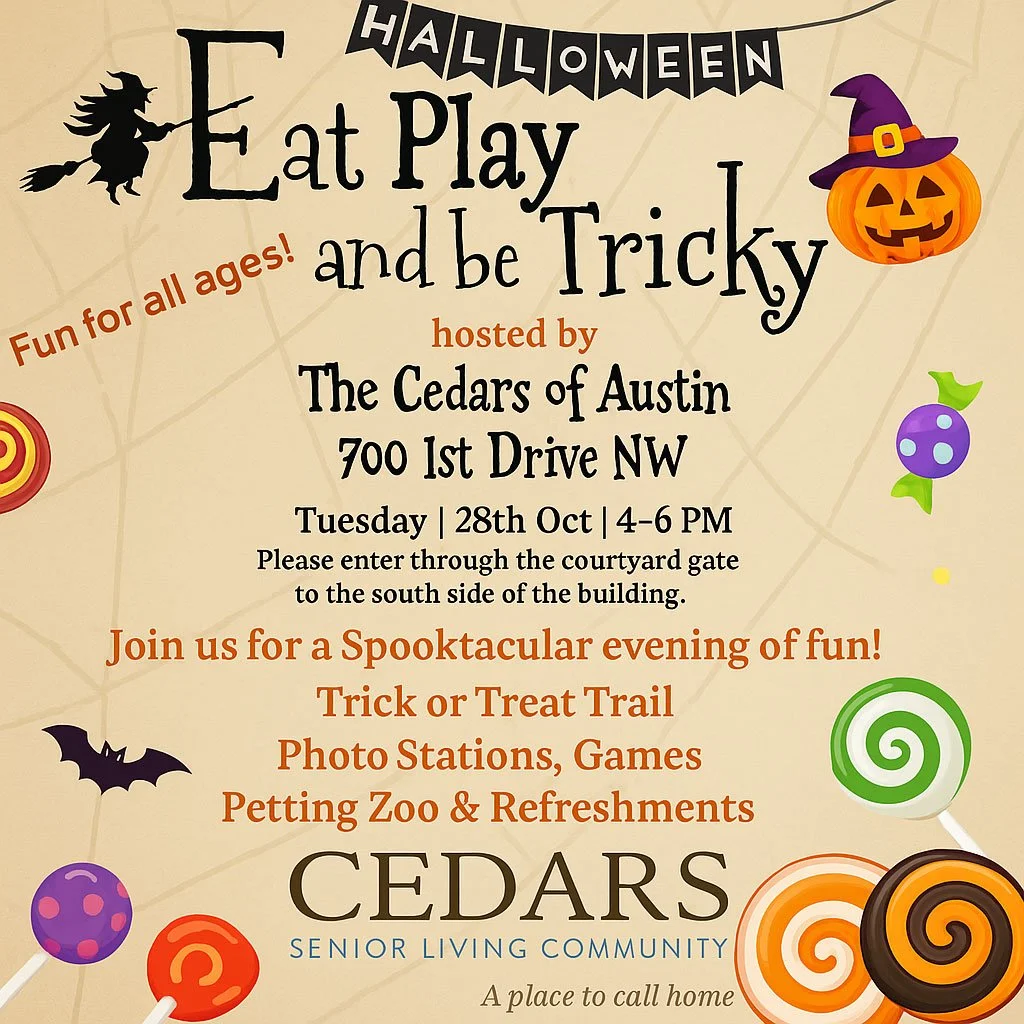

🎃 Eat, Play, and Be Tricky: Join Us for a Spooktacular Halloween at The Cedars of Austin!

Celebrate Halloween at The Cedars of Austin! Join us on October 28th for a family-friendly evening filled with trick-or-treating, games, photo stations, a petting zoo, and refreshments. Open to all ages, this community event brings neighbors together for fun, laughter, and seasonal cheer.

The Benefits of Pet Therapy in Senior Care

At The Cedars of Austin, pet therapy brings comfort, joy, and companionship to residents in Independent Living, Assisted Living, and Memory Care. Discover how animals help reduce stress, encourage engagement, and boost emotional well-being.

Why Loneliness is a Health Risk—and How Senior Living Can Help

At The Cedars of Austin, no one has to face life alone. Discover how our vibrant community helps seniors combat loneliness and enjoy a healthier, happier life.

What to Expect During the Move-In Process at The Cedars of Austin

Moving into a senior living community is a big step, and at The Cedars of Austin, we make it a smooth, supportive, and welcoming experience. From personalized move-in guidance to a friendly orientation and ongoing support, we’re here every step of the way to help you—or your loved one—settle in with confidence and comfort. Discover what to expect during your move and start your new chapter with peace of mind.

How to Know When It’s Time for Senior Living

Wondering If It’s Time for Senior Living?

You’re not alone. Deciding when to make the move is never easy, but recognizing the signs can help. At The Cedars of Austin, we’ve guided many families through this transition. Here are some key things to look for—and how we can help when the time feels right.

Meet Our Team: The People Who Make Our Community Special

Cathy Ehley, 20 Years of Leadership and Care.

Some people quietly shape a place over time—bringing consistency, compassion, and a deep sense of purpose to everything they do. At The Cedars of Austin, Cathy Ehley is one such person.